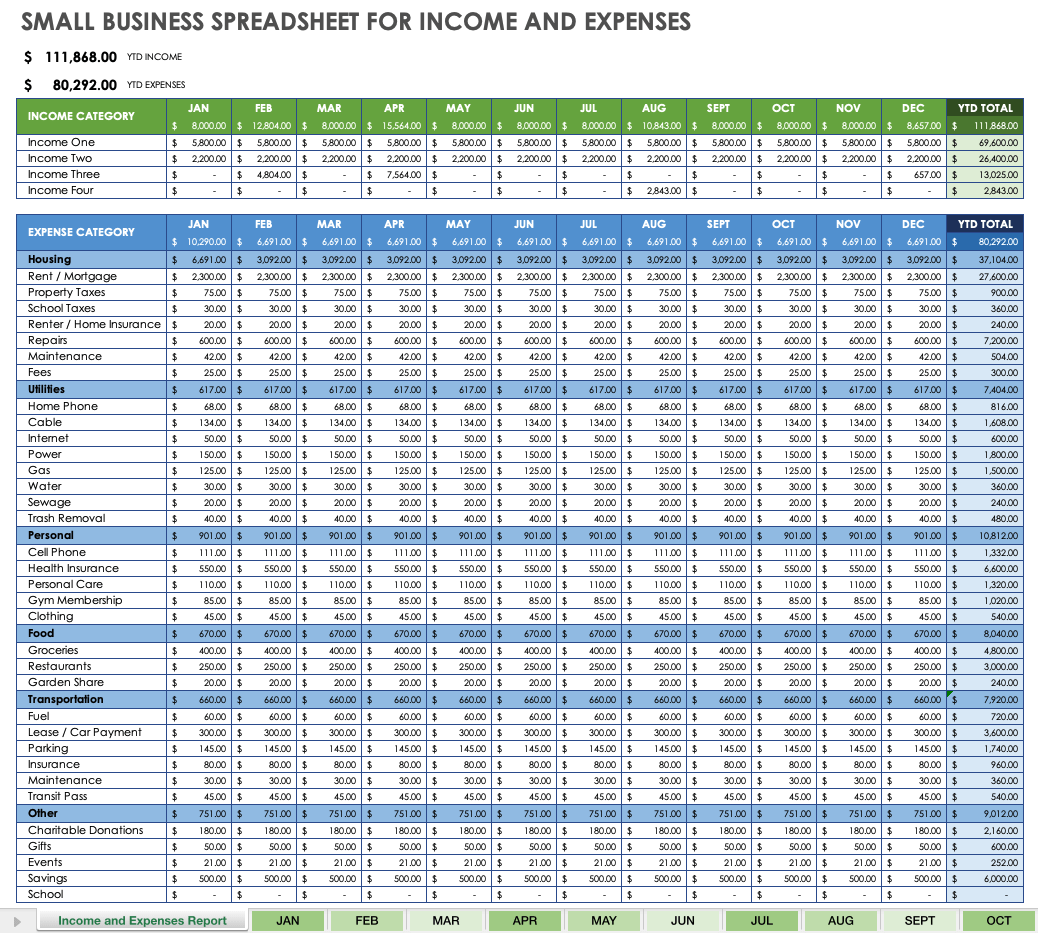

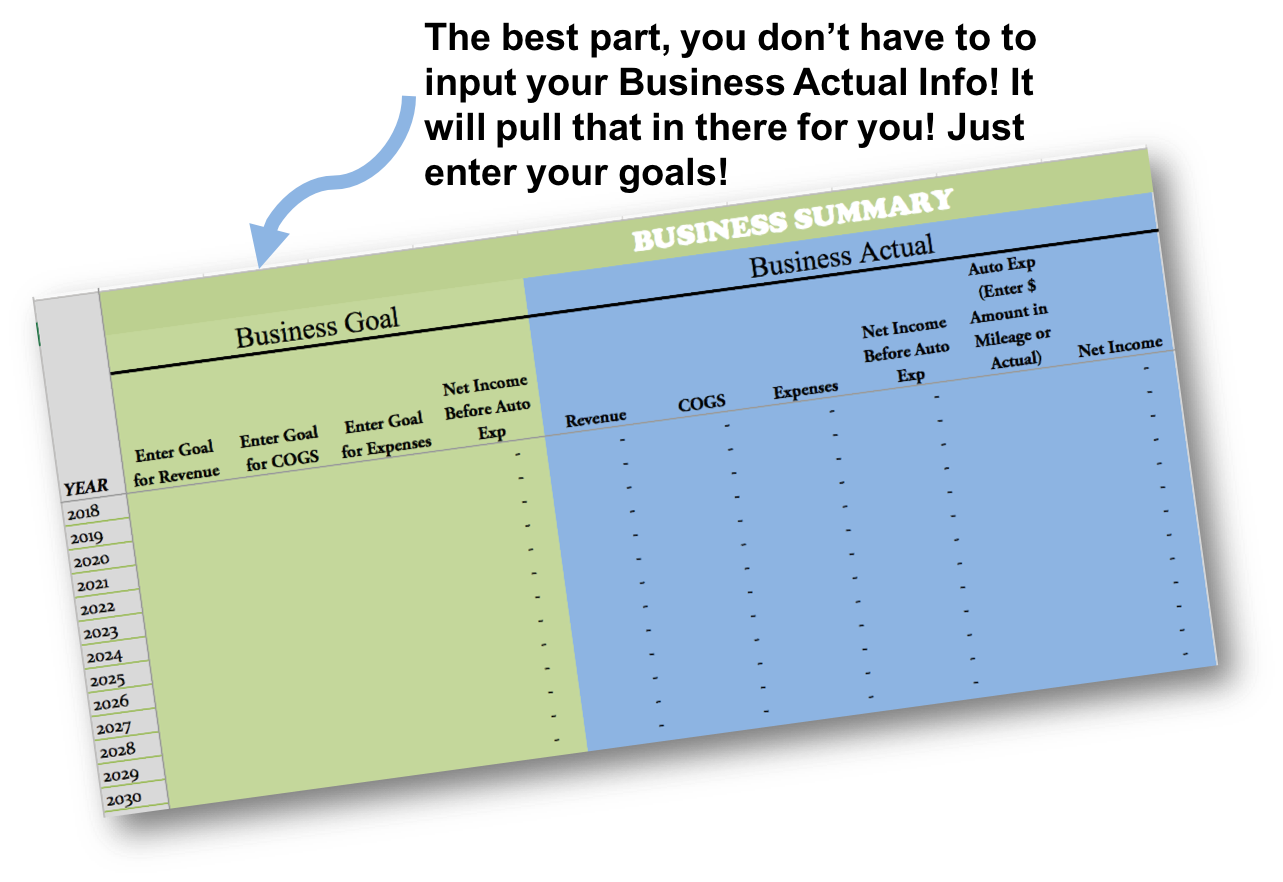

2024 Business Write Offs Excel – If not, you may wish to compile this information in an Excel spreadsheet can help you keep track of day-to-day business expenditures like gas, parking, meals, supplies, equipment and other items . The federal government should boost the instant asset write business 25% corporate tax rate to cover enterprises with a turnover of $250 million, up from its current $50 million cut-off. .

2024 Business Write Offs Excel

Source : www.pinterest.comFree Small Business Expense Report Templates | Smartsheet

Source : www.smartsheet.comLos Angeles Business Journal on X: “The Los Angeles Business

Source : twitter.com2023/2024 Financial Year Business Expenses Template Digital

Source : www.etsy.comFree Business Expense Tracking Spreadsheet (2024)

Source : www.betterwithbenji.comHow to Create an Expense Report in Excel: Free Template

Source : clickup.com2023/2024 Financial Year Business Expenses Template Digital

Source : www.etsy.comHow to Create an Expense Report in Excel: Free Template

Source : clickup.com2019 Photography Tax Spreadsheets, 400 Tax Write Offs, Audit Guide

Source : bp4uphotographerresources.comBusiness Expense Tracker Spreadsheet 2024 Expenses, Mileage Log

Source : www.etsy.com2024 Business Write Offs Excel Business Tax Deductions Cheat Sheet Excel Deductible Tax Write : Write-offs are a specialized form of tax deduction. When a business spends money on equipment or operating expenses, it can deduct that spending from its taxes. The same is true when a business . Oh my God, this is true physical labor,” Samira Shihab, a Jakarta-based founder, told BI. .

]]>